mortgage refinance transfer taxes

Transfer Taxes Transfer tax is at the rate of. You need to include both of your 1098 forms on your return.

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

So you can use a cash-out refinance to convert interest paid on credit cards and other non-deductible debts to tax-deductible interest by rolling it into your mortgage.

. 500 2 is 1000 and that would be what you owe in transfer taxes for the sale. If your home is assessed at 300000 and your tax rate is 3 percent youll pay 9000 a year in property tax. Rent you receive from tenants is taxable income and you must.

Ontario land transfer tax rebate in Ontario 3. Refinancing your mortgage and more so you can feel confident when you make decisions as. For first time home buyers there is a maximum 4000 tax rebate on the Ontario land transfer tax.

The IRS allows you to write off the interest on up to 1000000 in home acquisition debt which includes the funds. Youll receive two 1098 forms this year and. In some states the transfer tax is known by other names.

The rules are different when youre refinancing the mortgage on a property you use to generate rental income. Transfer tax differs across the US. For example if you earn 50000 a year before taxes and you have 5000.

Transfer Tax 19 14 County 5 State - Recordation Tax also charged on refinances and 2nd trusts if property is not owner occupied. Mortgage transfer taxes often referred to as mortgage recording taxes are fees imposed by state and local governments whenever you take out a new mortgage. That means a home that sells for 1 million is has a transfer tax of 14.

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. It might also be added that apparently there is a. - Recordation Tax also charged if owner occupied.

You reduce the overall amount of money that you need to pay taxes on when you take a deduction. However a refinance loan is not a sale because the property is not changing hands. The sale of a property can trigger a tax assessment in some places including California.

A property selling for. Your property taxes will only go up if your rate or assessment. In contrast to a property transfer Maryland State law and the County do not require that property taxes must be paid if you refinance your mortgage.

So if you purchase 2000 worth of mortgage points on a 15-year refinance for instance you can deduct about 13333 per year for the duration of the loan. Refinance transfer taxes refinance mortgage transfer tax florida florida transfer taxes for refinance florida mortgage refinance tax florida state mortgage tax florida transfer taxes. The tax must be paid again when.

You may be able to deduct certain costs like mortgage interest but only if you itemize. For example Colorado has a transfer tax rate of 001 while people. Your cash-out refinance mortgage may not be completely tax deductible.

Real estate transfer taxes are different from property tax estate tax and gift tax. Risks of a cash. If you sold the property for 250000 you would divide 250000 by 500 which is 500.

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Here are some things to know about home refinancing and your taxes. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Refinance loans are treated like other mortgage loans when it comes to your taxes. Essentially this new mortgage is treated as a brand-new loan and is subject to the new limits with only the acquisition portion eligible for the tax deduction. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Yes the CEMA process allows you to only pay the mortgage tax on the new money. 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of. Based on Ontarios land transfer tax rates.

18th May 2010 0533 am. Unlike real estate transfer taxes mortgage transfer taxes are calculated as a percentage of the mortgage instead of a percentage of the homeâs sale price. When the same owner s retain the property and simply.

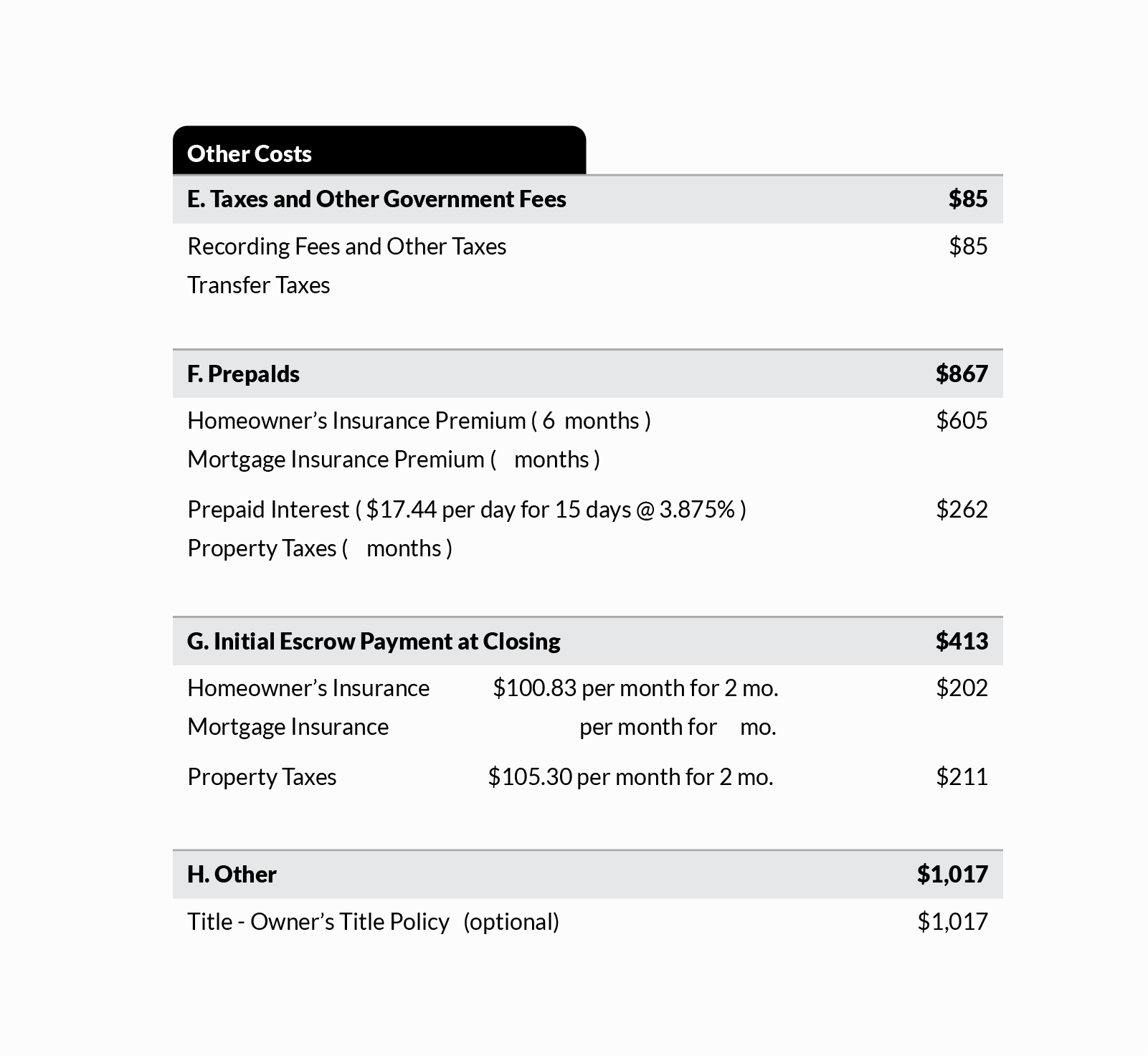

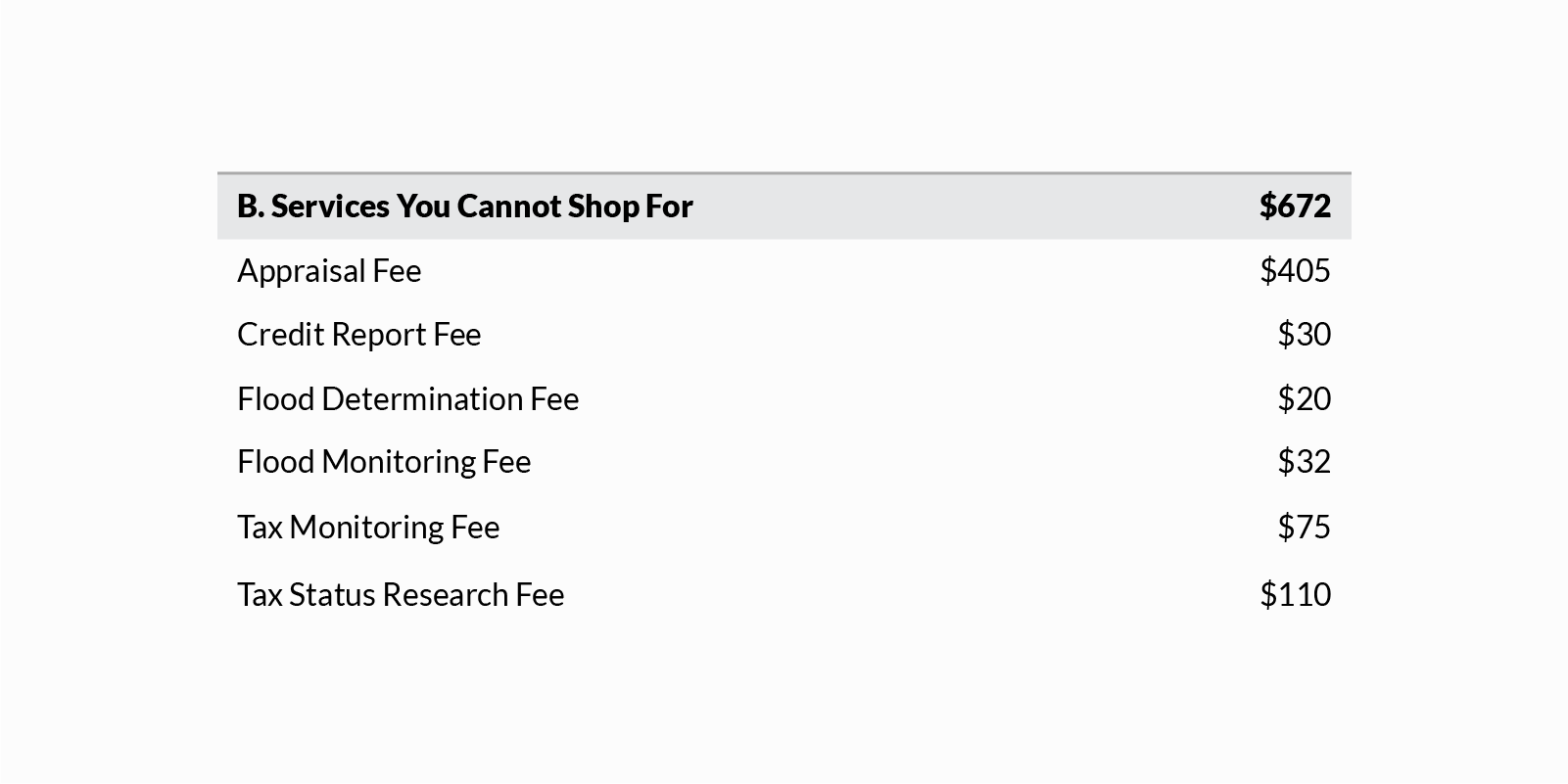

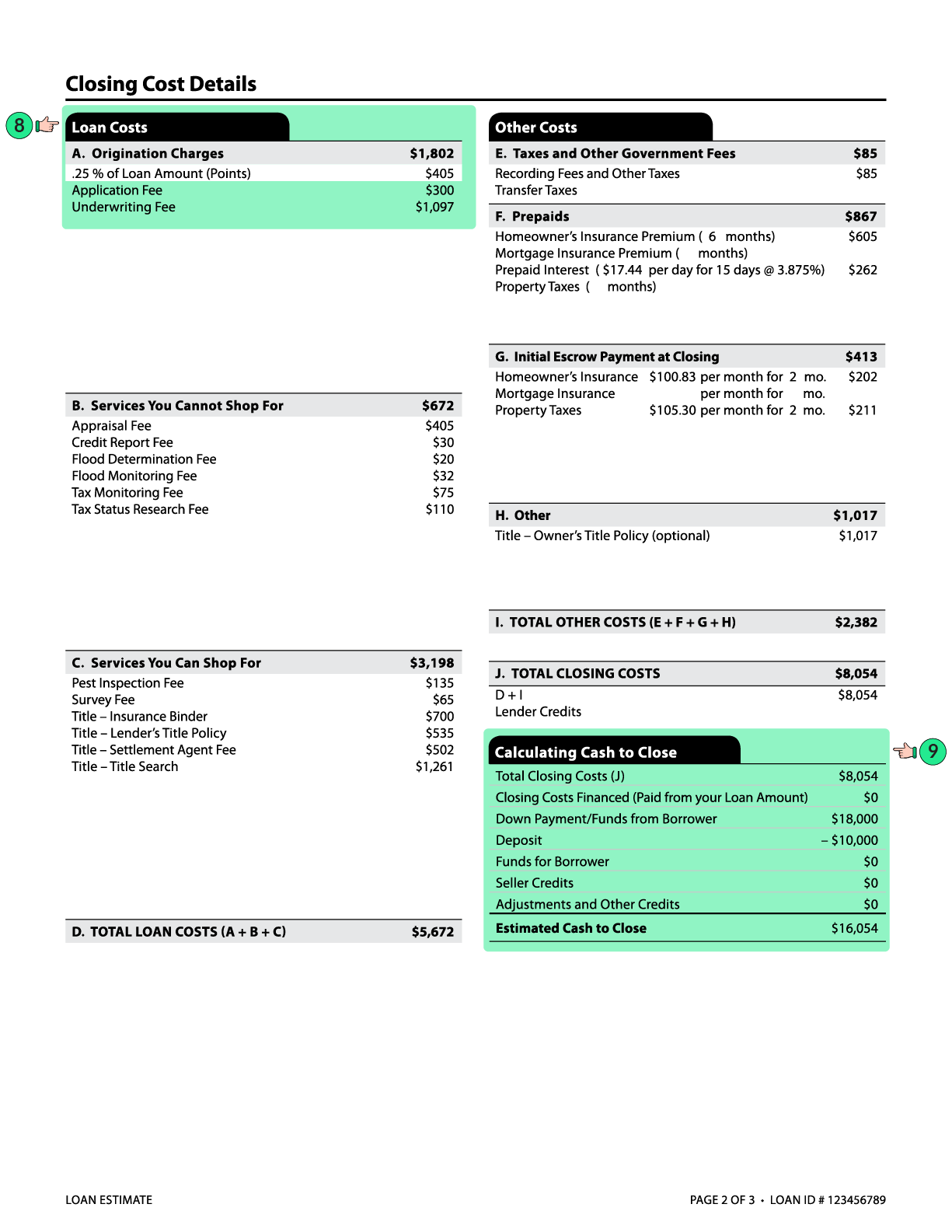

Understanding Mortgage Closing Costs Lendingtree

What Is A Loan Estimate How To Read And What To Look For

No Closing Cost Mortgage Is It Actually Worth It Credible

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Refinancing Your House How A Cema Mortgage Can Help

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Understanding Mortgage Closing Costs Lendingtree

What Is A Loan Estimate How To Read And What To Look For

Understanding Mortgage Closing Costs Lendingtree

Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Mortgage Tips Transfer